| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

MYRIAD GENETICS, INC.

October 12, 2017

YouStakeholders,

Atattend the Annual Meeting, three persons will be electedvote and submit your questions during the meeting by visiting the following URL: www.virtualshareholdermeeting.com/MYGN2024 and entering the 16-digit control number included in the Notice of Internet Availability of Proxy Materials or proxy card that you receive. For further information about the virtual Annual Meeting, please call our investor relations department at (801) 584-3532.

Under Securities and Exchange Commission rules that allow companies to furnish proxy materials to stockholders over the Internet, we have elected to deliver our proxy materials to the majority of our stockholders in this manner. We believe this process will facilitate the accelerated delivery of proxy materials, save costs and reduce the environmental impact of our Annual Meeting. On or about October 12, 2017, we began sending our stockholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access the proxy statement for our 2017

We hope you will be able to attend the Annual Meeting. Whether you plan to attend the meeting or not, it is important that you cast your vote. You may vote over the Internet as well as by telephone. In addition, if you requested printed proxy materials, you may vote by completing, signing, dating and returning your proxy card by mail. You are urged to vote promptly in accordance with the instructions provided in the Notice of Internet Availability of Proxy Materials or on your proxy card. We encourage you to vote by proxy so that your shares will be represented and voted at the meeting, whether or not you attend.

|

Your vote is important. Please vote as soon as possible by using the Internet or by telephone or, if you received a paper copy of the proxy card by mail, by completing, signing, dating, and returning the enclosed proxy card. Instructions for your voting options are described on the Notice of Internet Availability of Proxy Materials or proxy card.

MYRIAD GENETICS, INC.

320 Wakara Way

Salt Lake City, Utah 84108

NOTICE OF 2017 ANNUAL MEETING OF STOCKHOLDERS

TIME: 9:00 a.m. MST

DATE: Thursday, November 30, 2017

PLACE: The offices of Myriad Genetics, Inc., 320 Wakara Way, Salt Lake City, Utah 84108

PURPOSES:

WHO MAY VOTE:

Myriad Genetics, Inc., 322 North 2200 West, Salt Lake City, Utah 84116.

BY ORDER OF |

|

October 12, 2017

IMPORTANT NOTICE REGARDING THE AVAILABILITYBOARD OF PROXY MATERIALS FOR THE

STOCKHOLDER MEETING TO BE HELD ON NOVEMBER 30, 2017

DIRECTORSPaul J. DiazPresident and Chief Executive OfficerApril 17, 2024Important Notice Regarding the Availability of Proxy Materials forthe Stockholder Meeting to be held on June 6, 2024This proxy statement, and our annual report on Form 10-K to stockholders for the fiscal year ended June 30, 2017December 31, 2023, are available for viewing, printing, and downloading atwww.proxyvote.com. To view these materials, please have available your 12-digit16-digit control number(s) that appears on your Notice or proxy card. On this website, you can also elect to receive future distributions of our proxy statements and annual reports to stockholders by electronic delivery.Additionally, you may find a copy of our annual report on Form 10-K, which includes our financial statements for the fiscal year ended June 30, 2017,December 31, 2023, on the website of the Securities and Exchange Commission atwww.sec.gov, or in the “Financial‘‘Financial Reporting/SEC Filings”Filings’’ section of the “Investors”‘‘Investor Relations’’ section of our website atwww.myriad.com.www.myriad.com. You also may obtain a printed copy of our annual report on Form 10-K, as amended, including our financial statements from us, free of charge, by sending a written request to: Corporate Secretary, Myriad Genetics, Inc., 320 Wakara Way,322 North 2200 West, Salt Lake City, Utah 84108.84116. Exhibits will be provided upon written request and payment of an appropriate processing fee.

| Time and Date: | 8:00 a.m. Mountain Daylight Time on Thursday, June 6, 2024 | |||||||||||||

| Place: | The Annual Meeting will be a completely virtual meeting. There will be no physical meeting location and the meeting will only be conducted via live webcast at the following address: www.virtualshareholdermeeting.com/MYGN2024 | |||||||||||||

| Record Date: | Thursday, April 11, 2024 (as of the close of business) | |||||||||||||

| Mailing Date: | This proxy statement was first mailed or made available to stockholders on or about April 17, 2024 | |||||||||||||

| Voting: | Stockholders as of the record date are entitled to vote. Each share of common stock is entitled to one vote for each director nominee and one vote for each of the other proposals | |||||||||||||

| Proposals | Board Vote Recommendation | Page | ||||||||||||

| 1. Elect Two Directors | FOR EACH NOMINEE | P. 67 | ||||||||||||

| 2. Ratification of Ernst & Young LLP as our Independent Registered Public Accounting Firm for 2024 | FOR | P. 68 | ||||||||||||

| 3. Advisory Vote to Approve Executive Compensation | FOR | P. 70 | ||||||||||||

Via the Internet | www.proxyvote.com until 11:59 p.m. Eastern Daylight Time on Wednesday, June 5, 2024. | ||||||||||

| By Telephone | Call the phone number located on your Notice or on the top of your proxy card until 11:59 p.m. Eastern Daylight Time on Wednesday, June 5, 2024. | ||||||||||

| By Mail | Complete, sign, date and return your proxy card or voting instruction card so that it is received before the polls close on Thursday, June 6, 2024. | ||||||||||

| In-Person | Whether you are a stockholder of record or hold your shares in "street name," you may participate in and vote online at the Annual Meeting. You will need to enter your 16-digit control number to vote your shares at the Annual Meeting. Please visit www.virtualshareholdermeeting.com/MYGN2024 for instructions on how to attend the Annual Meeting live over the Internet. To vote during the Annual Meeting when the polls open use the "vote" button on the interface. | ||||||||||

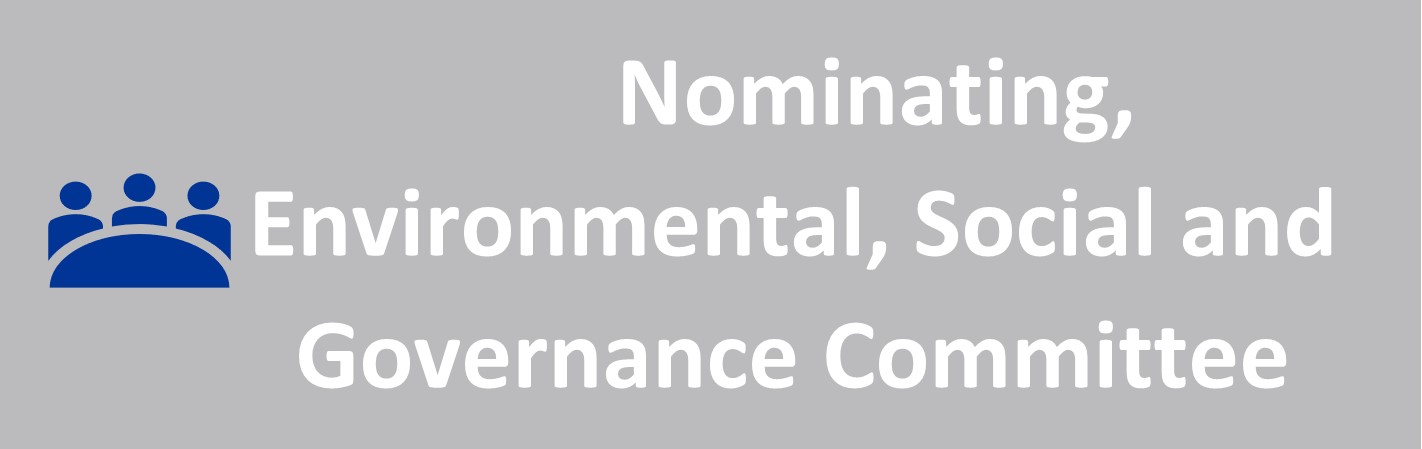

•Eight out of nine directors are independent | •Compensation clawback policy | ||||

•The roles of Board Chair and CEO are separate | •Annual say-on-pay vote | ||||

•Board committees include only independent directors | •Demonstrated commitment to stockholder engagement | ||||

•44% of Board members are women or ethnically diverse | •Anti-hedging and anti-pledging policies | ||||

•Annual Board and committee self-assessments, including one-on-one interviews led by the Board Chair | •Board has significant interaction with senior management and access to other employees | ||||

•Majority voting in uncontested director elections, with resignation policy | •Robust stock ownership guidelines for non-employee directors and executive officers | ||||

•Commitment to Board refreshment: seven new directors appointed in last five years, including a new director in 2022 | •Limits on board member service on other public company boards | ||||

•Mandatory director retirement age | •No stockholder rights or similar plan | ||||

•NESGC regularly assesses the effectiveness of each director | |||||

| What We Do: | What We Don't Do: | ||||

•Grant 50% of executive officers' equity in the form of PSUs that are subject to objective performance metrics | •Reprice stock options and other awards without stockholder approval | ||||

•Cap PSUs earned at target if absolute total stockholder return is negative over the performance period | •Provide single-trigger change of control vesting for equity awards for executive officers | ||||

•Establish challenging performance metrics, including revenue and adjusted operating income targets | •Guarantee bonuses | ||||

•Require directors and executive officers to meet robust stock ownership guidelines | •Grant in-the-money stock options | ||||

•Provide full vesting of time-based restricted stock units under our 2023 long-term incentive plan to executive officers only after three years | •Provide excessive perquisites | ||||

•Evaluate officer compensation levels against a peer group of similarly situated companies | •Repurchase underwater stock options | ||||

•Retain an independent compensation consultant | |||||

•Prohibit hedging transactions (no waivers granted) | |||||

•Utilize employee engagement and customer net promoter score as performance metrics in our 2023 short-term incentive plan | |||||

•Prohibit short sales, put and call options and other speculative transactions | |||||

•Prohibit pledging or the use of common stock to secure a margin or other loan (no waivers granted) | |||||

•Hold an annual advisory vote on executive compensation | |||||

•Subject incentive compensation to recoupment under our clawback policy | |||||

| Name | Principal Occupation | Director Since | Independent | Board Committees | Other Public Company Boards | ||||||||||||

| S. Louise Phanstiel * | ** | Former Senior Executive, Elevance Health, Inc. (formerly WellPoint, Inc.) | 2009 | ☑ | AFC, CHCC, NESGC | BFLY | ||||||||||||

| Paul J. Diaz | President and Chief Executive Officer of Myriad Genetics, Inc. | 2020 | |||||||||||||||

| Paul M. Bisaro + | Former Executive Chairman, Amneal Pharmaceuticals, Inc. and President and Chief Executive Officer, Impax Laboratories, Inc. | 2022 | ☑ | NESGC, RPIC | ZTS, MNKTQ | ||||||||||||

| Heiner Dreismann, Ph.D. | Former Senior Executive, the Roche Group | 2010 | ☑ | CHCC^, RPIC | MYNZ | ||||||||||||

| Rashmi Kumar | Senior Vice President, Chief Information Officer, Medtronic plc | 2020 | ☑ | AFC, NESGC | - | ||||||||||||

| Lee N. Newcomer, M.D. | Former Senior Vice President for Oncology and Genetics, Chief Medical Officer, UnitedHealth Group | 2019 | ☑ | CHCC, RPIC^ | CHRS | ||||||||||||

| Colleen F. Reitan | Former Executive Vice President and President of Plan Operations and Chief Operating Officer, Health Care Services Corporation | 2019 | ☑ | AFC, NESGC^ | ALNY | ||||||||||||

| Daniel M. Skovronsky, M.D., Ph.D. ** | President, Lilly Research Laboratories, Chief Scientific Officer at Eli Lilly and Company | 2020 | ☑ | CHCC, RPIC | - | ||||||||||||

| Daniel K. Spiegelman ++ | Former Executive Vice President and Chief Financial Officer at BioMarin Pharmaceuticals, Inc. | 2020 | ☑ | AFC^++ | SPRB, KYTX | ||||||||||||

320 WAKARA WAY

84116

PROXY STATEMENT FOR THE MYRIAD GENETICS, INC.

2017 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON NOVEMBER 30, 2017

584-3532

‘‘us.’’

IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

April 17, 2024.

1

all of the proxy materials and submit your proxy on the Internet or by telephone. If you requested a paper copy of the proxy materials, you may authorize the voting of your shares by following the instructions on the enclosed proxy card, in addition to the other methods of voting described in this proxy statement.

| By Internet or by telephone | ||||

| To vote by Internet or telephone in advance of the meeting, follow the instructions included in the Notice or, if you received printed materials, in the proxy card, to vote by Internet or telephone. | |||||

| By mail | ||||

| If you received your proxy materials by mail, you can vote by completing, signing, dating and returning the proxy card as instructed on the card. If you sign the proxy card but do not specify how you want your shares voted, they will be voted in accordance with the Board’s recommendations as noted below. | |||||

| At the meeting | ||||

| To vote by Internet directly during the webcast of the Annual Meeting, you will need to visit the following URL: www.virtualshareholdermeeting.com/MYGN2024 and enter your control number. To vote during the Annual Meeting when the polls open use the ‘‘vote’’ button on the interface. | |||||

June 5, 2024.

2

banks and brokers. If your shares are not registered in your own name and you plan to vote your shares in person at the Annual Meeting, you should contact your broker or agent to obtain a legal proxy or broker’s proxy card and bring it tobefore the meeting in order to vote.

To vote you must be a stockholder of record as of April 11, 2024 and use the ‘‘vote’’ button during the online Annual Meeting to vote your shares.

3

firm if your bank, broker or other nominee exercises their discretion to vote your shares on this proposal.

Proposal 1: Elect Directors | The | Recommendation: FOR the election of the two Class I directors | |||||||

Proposal 2: | |||||||||

| |||||||||

4

Ratify the Selection of our Registered Independent Public Accounting Firm | The affirmative vote of a majority of the shares voted affirmatively or negatively for this proposal is required to ratify the selection of Ernst & Young LLP as our independent registered public accounting | |||||

Recommendation: FOR | ||||||

Proposal Approve, on an Advisory Basis, the Compensation of Our Named Executive Officers | The affirmative vote of a majority of the shares voted affirmatively or negatively for this proposal is required to approve, on an advisory basis, the compensation of our named executive officers, as disclosed in this proxy statement. Abstentions will have no effect on the result of this vote. Brokerage firms do not have authority to vote customers’ unvoted shares held by | |||||

| Recommendation: FOR | |||||

5

6

7

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of our common stock as of September 1, 2017 for (a) each stockholder that we know to be the beneficial owner of more than 5% of our common stock, (b) each of our executive officers named in the Summary Compensation Table of this proxy statement (the “Named Executive Officers” or “NEOs”), (c) each of our directors

| Shares Beneficially Owned | ||||||||

Name and Address** | Number | Percent | ||||||

5% or More Stockholders | ||||||||

Baillie Gifford & Co. (1) | 10,159,758 | 14.8 | % | |||||

Calton Square — 1 Greenside Row | ||||||||

Edinburgh, Scotland EH13AN | ||||||||

BlackRock, Inc (2) | 9,391,168 | 13.7 | % | |||||

55 East 52nd Street | ||||||||

New York, NY 10055 | ||||||||

The Vanguard Group (3) | 5,353,743 | 7.8 | % | |||||

100 Vanguard Blvd. | ||||||||

Malvern, PA 19355 | ||||||||

Camber Capital Management LLC (4) | 4,060,000 | 5.9 | % | |||||

101 Huntington Avenue, Suite 2101 | ||||||||

Boston, MA 02199 | ||||||||

State Street Corporation (5) | 3,589,079 | 5.2 | % | |||||

One Lincoln Street | ||||||||

Boston, MA 02111 | ||||||||

D.E. Shaw & Co, L.P. (6) | 3,411,217 | 5.0 | % | |||||

1166 Avenue of the Americas, 9th Floor | ||||||||

New York, NY 10036 | ||||||||

Named Executive Officers | ||||||||

Mark C. Capone (7) | 1,333,467 | 1.9 | % | |||||

R. Bryan Riggsbee (8) | 37,160 | * | ||||||

Alexander Ford (9) | 130,976 | * | ||||||

Jerry S. Lanchbury, Ph.D. (10) | 804,039 | 1.2 | % | |||||

Richard M. Marsh (11) | 988,349 | 1.4 | % | |||||

8

Directors and Director Nominees | ||||||||

John T. Henderson, M.D. (12) | 207,800 | * | ||||||

Walter Gilbert, Ph.D. (13) | 102,500 | * | ||||||

Lawrence C. Best (14) | 167,500 | * | ||||||

Heiner Dreismann, Ph.D. | 17,500 | * | ||||||

Dennis H. Langer, M.D., J.D. (15) | 167,500 | * | ||||||

S. Louise Phanstiel (16) | 163,500 | * | ||||||

All current executive officers and directors as a group (15 persons) (17) | 4,858,238 | 6.7 | % |

9

10

MANAGEMENT AND CORPORATE GOVERNANCE

On September 14, 2017, our

Mr. Spiegelman was not nominated for re-election. The Board, upon the recommendation of the NESGC, approved a reduction in the number of directors constituting the full Board from nine to eight directors, effective as of the Annual Meeting. Mr. Spiegelman will continue as a director through the date of the Annual Meeting, when his current term expires.

| Name and Position | Age | Audit and Finance Committee | Compensation and Human Capital Committee | Nominating, Environmental, Social and Governance Committee | Research and Product Innovation Committee | ||||||||||||||||

|

| ||||||||||||||||||||

| S. Louise Phanstiel Chair of the Board of Directors | 65 |  |  |  | ||||||||||||||||

| |||||||||||||||||||||

| Paul J. Diaz President, Chief Executive Officer, Director | 62 | |||||||||||||||||||

Paul M. Bisaro (1) Director | 63 |  |  | ||||||||||||||||||

| |||||||||||||||||||||

Heiner Dreismann, Ph.D. Director | 70 |  |  | ||||||||||||||||||

Rashmi Kumar Director | 54 |  |  | ||||||||||||||||||

Lee N. Newcomer Director | 72 |  |  | ||||||||||||||||||

Colleen F. Reitan Director | 64 |  |  | ||||||||||||||||||

Daniel M. Skovronsky M.D., Director | 50 |  |  | ||||||||||||||||||

Daniel K. Spiegelman Director (2) | 65 |  | |||||||||||||||||||

| |||||

|

| |||||

| Research and Product Innovation Committee | ||||

| C | Committee Chair |

The following is

John T. Henderson, M.D., ChairmanFinance Committee and serve as the Chair of the Board of Directors, has beenAudit and Finance Committee.

11

pharmaceutical industry as President of Futurepharm LLC. Dr. Henderson currently serves on the Board of Directors of Cytokinetics, Inc. and during the past five years has served on the Board of Directors of Myrexis, Inc. Until his retirement in December 2000, he was with Pfizer for over 25 years, most recently as a Vice President in the Pfizer Pharmaceuticals Group. Dr. Henderson previously held vice presidential level positions with Pfizer in Research and Development in Europe and later in Japan. He also was Vice President, Medical for the Europe, U.S. and International Pharmaceuticals groups at Pfizer. He earned his bachelor’s and medical degrees from the University of Edinburgh and is a Fellow of the Royal College of Physicians (Ed.).

The Board of Directors has determined that Dr. Henderson should serve on the Board for the following reasons: His medical background provides the Board with expertise in developing predictive, personalized and prognostic testing services. Dr. Henderson provides the Board with business and management expertise from his senior positions at Pfizer for over 25 years, including expertise in research and development, which is critical to our development of molecular diagnostic testing services. He brings to the Board international experience as the Company implements strategies for international expansion.

Walter Gilbert, Ph.D., Vice Chairman of the Board of Directors, joined Myriad as a founding scientist and director in March 1992. Dr. Gilbert won the Nobel Prize in Chemistry in 1980 for his contributions to the development of DNA sequencing technology. He was a founder of Biogen, Inc. and its Chairman of the Board and Chief Executive Officer from 1981 to 1985. Dr. Gilbert has held professorships at Harvard University in the departments of Physics, Biophysics, Biology, Biochemistry and Molecular Biology, and Molecular and Cellular Biology. He is a Carl M. Loeb University Professor Emeritus at Harvard University. Dr. Gilbert founded and served on the Board of Directors of both Memory Pharmaceuticals Corp. and Paratek Pharmaceuticals, Inc. He also currently serves on the board of Amylyx Pharmaceuticals and is a General Partner of BioVentures Investors, an investment fund.

The Board of Directors has determined that Dr. Gilbert should serve on the Board for the following reasons: He provides the Board with a unique and extensive scientific background and expertise important to us in developing and commercializing molecular diagnostic products, and understanding technological developments in the industry. Dr. Gilbert provides the Board with business, managerial and financial expertise based on having founded, managed, and directed several companies in the healthcare industry.

Mark C. Capone, was appointed as the President and Chief Executive Officer, or CEO, of Myriad Genetics, Inc., and a member of the Board of Directors effective July 1, 2015. Previously, he servedat the Annual Meeting.

Annual Meeting.

| S. Louise Phanstiel | ||||||||||||||

| Experience: | |||||||||||||

S. Louise Phanstiel, Chair of the Board, has been a director of Myriad since September 2009 and assumed the Chair of the Board role in March 2020, and held several executive positions at Elevance Health, Inc., formerly WellPoint, Inc. from 1996 to 2007. She was President, Specialty Products, which included behavioral health services; Senior Vice President, Chief of Staff and Corporate Planning in the Office of the Chairman; and Chief Accounting Officer, Controller and Chief Financial Officer for all WellPoint, Inc. subsidiaries. Previously, Ms. Phanstiel was a partner at the international services firm PricewaterhouseCoopers, LLP, formerly Coopers & Lybrand, LLP where she specialized in insurance. Ms. Phanstiel's life science experience includes having previously served on the board of directors and Chair of the audit committees at publicly traded companies, Inveresk Research Group, Inc. and Verastem, Inc. Ms. Phanstiel is currently a member of the board of directors of Butterfly Network, Inc. The Board has determined that Ms. Phanstiel should serve on the Board for the following reasons: She provides the Board with important expertise in the healthcare industry based on her extensive experience in several senior positions at WellPoint, Inc. This expertise is critical as we rely on healthcare third-party reimbursement for our molecular diagnostic testing services. Ms. Phanstiel also provides the Board with financial accounting, internal control and public company reporting expertise from her work at Coopers & Lybrand, LLP and as a Certified Public Accountant. In addition, she provides the Board with business, financial and investment expertise, as well as management expertise, resulting from managing and service as a director of publicly traded companies. Ms. Phanstiel also provides the Board with valuable experience from serving as a director of Myriad since September 2009, and as Chair of the Board since March 2020, during which time she has made significant contributions to Myriad, including navigating us through the COVID-19 pandemic and its impact on our business, hiring a new Chief Executive Officer (Mr. Diaz), and presiding over the refreshment of our Board which included the appointment of five new directors and the appointment of a new executive leadership team. | ||||||||||||||

| Age: 65 | ||||||||||||||

Director Since:2009 | ||||||||||||||

| Committees: | ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| Paul J. Diaz | ||||||||||||||

| Experience: | |||||||||||||

Paul J. Diaz was appointed as the President and Chief Executive Officer, or CEO, of Myriad Genetics, Inc., and a member of the Board, effective August 13, 2020. Mr. Diaz was most recently a partner at Cressey & Company (2016-2020), a private investment firm headquartered in Chicago, Illinois, which at that time managed over $3.0 billion in committed capital. Cressey & Company is a healthcare focused middle-market private equity firm with over 30 years of success investing in and helping to build high quality healthcare businesses. Mr. Diaz is the former president and CEO and vice chairman of Kindred Healthcare, Inc. (2002-2016) then a Fortune 500 Company and one of the largest providers of healthcare services in the United States. At the time, Kindred had revenues of $7.2 billion, rehabilitation hospitals, sub-acute units, home health and hospice agencies and contract rehabilitation locations. For six years in a row, during his tenure as CEO, Kindred was ranked as one of the Most Admired healthcare companies in the United States by Fortune magazine. Mr. Diaz currently serves on the board of trustees of Johns Hopkins Medicine (where he serves as chair of Johns Hopkins Health Plans). He was formerly on the board of directors of DaVita (NYSE: DVA) and PharMerica Corporation (NYSE: PMC), and previously served on the board of the Federation of American Hospitals, and the Bloomberg School of Public Health at Johns Hopkins University. While CEO of Kindred, Mr. Diaz was a member of the Business Roundtable and the Wall Street Journal CEO Council. Modern Healthcare magazine named Mr. Diaz one of the 100 Most Influential People in Healthcare and named him one of the top 25 Minority Executives in Healthcare for numerous years. In addition, Hispanic magazine named Mr. Diaz one of the 25 Best Latinos in business in multiple years. Mr. Diaz earned a bachelor’s degree in Finance and Accounting from American University’s Kogod School of Business and a law degree from Georgetown University Law Center in Washington, D.C. The Board has determined that Mr. Diaz should serve on the Board for the following reasons: He provides the Board with important business and managerial expertise from his 15 years at Kindred Healthcare, including specific expertise in managing healthcare service companies and business transformation. Furthermore, Mr. Diaz has extensive experience in private equity with healthcare companies, including businesses in the personalized medicine space. Furthermore, his background in finance and accounting and law provides unique insights to our business. Mr. Diaz also has a background serving on both public and private healthcare boards. | ||||||||||||||

Age: 62 | ||||||||||||||

Director Since:2020 | ||||||||||||||

| President and Chief Executive Officer | ||||||||||||||

| Paul M. Bisaro | ||||||||||||||

| Experience: | |||||||||||||

Paul M. Bisaro was appointed as a director of Myriad on October 31, 2022. Mr. Bisaro is an accomplished global business leader with more than 30 years of generic and branded pharmaceutical experience. In February 2024, Mr. Bisaro was reappointed to serve as a director and the Chairman of the board of directors of Mallinckrodt, plc, a position he had previously held from June 2022 to November 2023. Mr. Bisaro is also currently a member of the board of directors of Zoetis Inc. He previously served on the board of Zimmer Biomet Holding, Inc. and TherapueticsMD. Mr. Bisaro’s executive work experience includes serving as the Executive Chairman of Amneal Pharmaceuticals, Inc., from May 2018 until August of 2019. Prior to that appointment, from May 2017 to May 2018, Mr. Bisaro was President and Chief Executive Officer, and member of the board of directors, of Impax Laboratories, Inc., until its acquisition by Amneal Pharmaceuticals. Prior to joining Impax Laboratories, Mr. Bisaro served as Executive Chairman of Allergan, plc, from July 2014 to November 2016, and as President and CEO of Actavis, plc (and its predecessor firm Watson Pharmaceuticals Inc.) from September 2007 to July 2014. Mr. Bisaro served on the board of directors of Allergan (and its predecessor firms) from September 2007 until August 2018. Prior to Watson, he served as President, Chief Operating Officer, and a member of the board of directors of Barr Pharmaceuticals, Inc., from 1999 to 2007. Between 1992 and 1999, Mr. Bisaro served as General Counsel of Barr. Prior to joining Barr, he was associated with the law firm Winston & Strawn and a predecessor firm, Bishop, Cook, Purcell and Reynolds and served as a Senior Consultant with Arthur Andersen & Co. Mr. Bisaro holds an undergraduate degree in General Studies from the University of Michigan and a JD from Catholic University of America in Washington, D.C. The Board has determined that Mr. Bisaro should serve on the Board for the following reasons: He provides the Board with more than 25 years of business, management and leadership experience in the pharmaceutical industry. He has a track record of driving company growth through operational execution and corporate transformation. In addition, he has extensive experience as a public company director and in mergers and acquisitions, finance, accounting, and legal matters, all of which makes him a valuable member of our Board. | ||||||||||||||

Age: 63 | ||||||||||||||

Director Since:2022 | ||||||||||||||

| Committees: | ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| Heiner Dreismann, Ph.D. | ||||||||||||||

| Experience: | |||||||||||||

Heiner Dreismann, Ph.D., joined as a director of Myriad in June 2010. He had a successful career at the Roche Group from 1985 to 2006 where he held several senior positions, including President and CEO of Roche Molecular Systems, Head of Global Business Development for Roche Diagnostics and member of Roche’s Global Diagnostic Executive Committee. Dr. Dreismann currently serves as the Chairman of the board of Mainz Biomed N.V. and as a director of Talis Biomedical Corporation. Previously, Dr. Dreismann served on the board of directors of Med BioGene, Inc., Genenews Limited, Interpace Diagnostics and Ignyta, Inc. He also currently serves on a number of early-stage private company boards in the biotechnology industry. He earned a M.S. degree in biology and his Ph.D. in microbiology/molecular biology (summa cum laude) from Westfaelische Wilhelms University (The University of Münster) in Germany. The Board has determined that Dr. Dreismann should serve on the Board for the following reasons: He provides the Board with important business and managerial expertise from his more than 20 years at Roche, including specific expertise in developing and commercially launching diagnostic products. Furthermore, Dr. Dreismann has extensive experience in international markets, specifically in Europe, while he was CEO of Roche Molecular Systems. His scientific background and expertise also enable him to provide the Board with technical advice on product research and development. Dr. Dreismann has a diversified background in managing and serving as a director of several companies in the healthcare industry. | ||||||||||||||

Age: 70 | ||||||||||||||

Director Since:2010 | ||||||||||||||

| Committees: | ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| Rashmi Kumar | ||||||||||||||

| Experience: | |||||||||||||

| Rashmi Kumar has been a director of Myriad since September 2020. Currently, Ms. Kumar serves as Senior Vice President, Chief Information Officer with Medtronic plc. She previously served as Senior Vice President and Chief Information Officer – Global IT with Hewlett Packard Enterprise (HPE) from January 2020 to November 2022. Ms. Kumar joined HPE in 2018 as VP Global IT to focus on Applications Operations, and Support, NGIT Program Build and Deployment, and technology leadership to enable HPE business to achieve transformation goals. She is a seasoned technology leader with wide ranging experience in IT leadership, healthcare, cybersecurity, consulting services, electric utilities, financial services, information technology, and media and entertainment and steel industries. With more than 25 years of experience, Ms. Kumar’s primary areas of focus include Digital Transformation, AI/ML, Data & Analytics, strategic planning, Enterprise Architecture, cybersecurity and large-scale business process transformations. Ms. Kumar has served as CIO and CTO for many Fortune 50 companies including McKesson, Southern California Edison, Toyota, HPE, and Tata Steel. Ms. Kumar earned a bachelor’s degree in Metallurgical Engineering from the Bihar Institute of Technology in Sindri, India. She also holds an MBA from the University of California, Irvine; Paul Merage School of Business. She is very passionate about the topic of equality and is executive sponsor for various ERG’s and sits on Diversity & Inclusion Steering committees. The Board has determined that Ms. Kumar should serve on the Board for the following reasons: She provides the Board with important expertise in the healthcare industry based on her extensive experience at McKesson Corp. and Medtronic. Ms. Kumar also has extensive experience in information technology management at leading companies across a diverse range of industries. This skill set is especially important as Myriad looks to upgrade its information technology systems relating to its customer interfaces. Ms. Kumar also has a strong scientific and engineering background providing expertise from a scientific and product development standpoint. | ||||||||||||||

Age: 54 | ||||||||||||||

Director Since:2020 | ||||||||||||||

| Committees: | ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| Lee N. Newcomer, M.D. | ||||||||||||||

| Experience: | |||||||||||||

Lee Newcomer, M.D., was appointed as a member of the Board in September 2019. Dr. Newcomer currently manages his own consulting business, Lee N. Newcomer Consulting, LLC, and previously held senior executive roles at United Healthcare including Senior Vice President for Oncology and Genetics, Chief Medical Officer and Senior Vice President of Health Policy and Strategy for UnitedHealth Group. Dr. Newcomer also worked for Vivius, Inc., a consumer directed health plan, holding the position of Executive Vice President and Chief Medical Officer. Dr. Newcomer received a Master’s Degree in Healthcare Administration & Management from the University of Wisconsin, Madison, an M.D. from the University of Nebraska, Omaha, and a B.S. from Nebraska Wesleyan University. Dr. Newcomer currently serves on the board of Cellworks Group Inc., a private precision medicine company and Coherus BioSciences, Inc., a public biopharmaceutical company. He also served on the board of directors of Park Nicollet Health Systems, a hospital health care system with approximately 1,000 physicians and 400 beds, for ten years including two years as Chairman. The Board has determined that Dr. Newcomer should serve on the Board for the following reasons: His extensive reimbursement and managed care experience will aid the Company in its efforts to expand reimbursement for its new innovative precision medicine tests. He provides the Board with expertise on the medical insurance industry based on his extensive experience in several senior positions at UnitedHealth Group, Inc. and CIGNA Corporation. Additionally, Dr. Newcomer’s medical background provides the Board with expertise in developing predictive, personalized and prognostic testing products. Furthermore, Dr. Newcomer brings extensive business management experience from his 28 years of work in the managed care and pharmaceutical industries. | ||||||||||||||

| Age: 72 | ||||||||||||||

Director Since:2019 | ||||||||||||||

| Committees: | ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| Colleen F. Reitan | |||||||||||||||||

| Experience: | ||||||||||||||||

| Colleen F. Reitan was appointed as a member of the Board in September 2019. Ms. Reitan previously held numerous senior leadership positions at Health Care Services Corporation (HCSC) including most recently as the Executive Vice President and President of Plan Operations and as the Chief Operating Officer. Prior to working at HCSC, Ms. Reitan held numerous senior management positions at Blue Cross and Blue Shield of Minnesota including President and Chief Operating Officer. In aggregate, Ms. Reitan has over 35 years of experience in the managed care industry. Ms. Reitan holds a B.A. from Minnesota State University at Mankato and a M.S. in Health Care Administration from the University of Minnesota-Twin Cities. She currently serves on the board of Alnylam Pharmaceuticals, Inc. The Board has determined that Ms. Reitan should serve on the Board for the following reasons: Her extensive reimbursement and managed care experience will aid the Company in its efforts to expand reimbursement for its new innovative precision medicine tests. Furthermore, she provides the Board with important expertise on the medical insurance industry based on her extensive experience in several senior positions at Health Care Services Corporation and Blue Cross and Blue Shield of Minnesota. In addition, she provides the Board with management expertise, resulting from managing private companies and serving as a director of a publicly-traded company. | |||||||||||||||||

| Age: 64 | |||||||||||||||||

Director Since:2019 | |||||||||||||||||

| Committees: | |||||||||||||||||

| |||||||||||||||||

| |||||||||||||||||

| Daniel M. Skovronsky, M.D., Ph.D. | ||||||||||||||

| Experience: | |||||||||||||

Daniel M. Skovronsky, M.D., Ph.D., joined the Company as a Director in July 2020. Currently, he serves as President of Lilly Research Laboratories, President of Lilly Immunology, and Chief Scientific Officer at Eli Lilly and Company. Previously, he was Chief Executive Officer of Avid Radiopharmaceuticals Inc., a company he founded in 2004. Dr. Skovronsky earned his M.D. from the Perelman School of Medicine, University of Pennsylvania, his Ph.D. in neuroscience from University of Pennsylvania and a B.S. in molecular biophysics and biochemistry from Yale University. The Board has determined that Dr. Skovronsky should serve on the Board for the following reasons: His medical and scientific background provides the Board with expertise in developing predictive, personalized, and prognostic testing products. Dr. Skovronsky provides the Board with business and management expertise from several senior positions at a major pharmaceutical company, including expertise in research and development, which is critical to our development of molecular diagnostic testing services. Dr. Skovronsky's background as a neuropathologist with extensive experience in neuroscience provides the Board with expertise in developing and commercializing diagnostics for patients suffering from neuropsychiatric and other medical conditions. As a director of Myriad, Dr. Skovronsky has made significant contributions to our research and development and product development efforts and our long-term growth strategy. | ||||||||||||||

Age: 50 | ||||||||||||||

Director Since:2020 | ||||||||||||||

| Committees: | ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| Daniel K. Spiegelman | ||||||||||||||

| Experience: | |||||||||||||

Daniel K. Spiegelman has been a director of the Company since May 2020. Most recently, he served as Executive Vice President and Chief Financial Officer at BioMarin Pharmaceuticals, Inc. Prior to that, he held several roles, including Senior Vice President and Chief Financial Officer of CV Therapeutics and Treasurer at Genentech, Inc. He is currently a member of the board of directors of Kyverna Therapeutics, Inc., a public clinical-stage biopharmaceutical company, and Spruce Biosciences, Inc., a public biopharmaceutical company. Mr. Spiegelman also serves on the board of directors of Tizona Therapeutics, Inc., a private pharmaceutical company, and Maze Therapeutics, a private biotechnology company. He previously served on the board of directors of Opthea Limited, Jiya Acquisition Corp., Cascadian Therapeutics, Inc., Rapidscan Pharma Solutions and Relypsa, Inc. Mr. Spiegelman received a B.A. degree from Stanford University and a M.B.A. from the Stanford Graduate School of Business. The Board has determined that Mr. Spiegelman should serve on the Board for the following reasons: He provides the Board with important expertise in the healthcare industry based on his extensive experience in several senior positions at major pharmaceutical companies. Mr. Spiegelman also provides the Board with financial accounting, internal control and public company reporting expertise from his work as Chief Financial Officer of multiple public companies and having served as the audit committee chair of multiple public companies. In addition, he provides the Board with business, financial and investment expertise, as well as management expertise, resulting from his experience as an executive, and service as a director, of multiple pharmaceutical companies. | ||||||||||||||

Age: 65 | ||||||||||||||

Director Since:2020 | ||||||||||||||

| Committees: | ||||||||||||||

| ||||||||||||||

Lawrence C. Best, a director of Myriad since September 2009, is the Chairman and Founder of OXO Capital LLC, an investment firm focused on life sciences and therapeutic medical device companies, since 2007. He joined Boston Scientific Corporation in 1992 and served for 15 years as the Executive Vice President-Finance & Administration and Chief Financial Officer. Prior to joining Boston Scientific, Mr. Best was a partner in the accounting

12

firm of Ernst & Young, where he specialized in serving multinational companies in the high technology and life sciences fields. He served a two-year fellowship at the SEC from 1979 to 1981 and a one-year term as a White House-appointed Presidential Exchange Executive in Washington, D.C. He is a founding directoror understanding of the President’s Council at Massachusetts General Hospital. Within the past five years Mr. Best also has served on the Boardfinancial and accounting function of Directors of Haemonetics Corp, Biogen, Inc.an enterprise in U.S. and as Executive Chairman of Valtech Cardio Ltd., a privately held medical device company basedinternational markets, resulting in Tel Aviv, Israel. He received a B.B.A. degree from Kent State University.

The Board of Directors has determined that Mr. Best should serve on the Board for the following reasons: He provides the Board with broadproficiency in complex financial management, capital allocation, mergers and acquisitions and financial accounting and reporting expertiseprocesses.

Heiner Dreismann, Ph.D., a director of Myriad since June 2010, had a successful career at the Roche Group from 1985 to 2006 where he held several senior positions, including President and CEO of Roche Molecular Systems, Head of Global Business Development for Roche Diagnostics and member of Roche’s Global Diagnostic Executive Committee. From 2006 to 2009, Dr. Dreismann served as the CEO of Vectrant Technologies, Inc., and until 2013 was the Interim CEO for GeneNews Limited. He currently serves on the Board of Directors of Ignyta, Inc. During the past five years, Dr. Dreismann served on the Board of Directors of Shrink Nanotechnologies, Med BioGene, Inc., Genenews Limited, and Interpace Diagnostics. He earned a M.S. degree in biology and his Ph.D. in microbiology/molecular biology (summa cum laude) from Westfaelische Wilhelms University (The University of Münster) in Germany.

The Board of Directors has determined that Dr. Dreismann should serve on the Board for the following reasons: He provides the Board with important business and managerial expertise from his more than 20 years at Roche, including specific expertiserisk management. Demonstrated strengths in developing talent, planning succession, and commercially launching diagnostic products. Furthermore, Dr. Dreismann has extensive experience in international markets, specifically in Europe, which is important as we seek to expand internationally. His scientific backgrounddriving change and expertise also enable him to providelong-term growth.

Dennis H. Langer, M.D., J.D., has been a director of Myriad since May 2004. From January 2013 to July 2014 he served as Chairman and Chief Executive Officer of AdvanDx, Inc. From August 2005 to May 2010, Dr. Langer served as Managing Partner of Phoenix IP Ventures, LLC. From January 2004 to July 2005, he was President, North America for Dr. Reddy’s Laboratories, Inc. From September 1994 until January 2004, Dr. Langer held several high-level positions at GlaxoSmithKline, and its predecessor, SmithKline Beecham, including most recently as a Senior Vice President of Research and Development. He has a broad base of experience in innovative R&D companies such as Eli Lilly, Abbott and Searle. He is also a clinical professor at the Department of Psychiatry, Georgetown University School of Medicine. Dr. Langer received a J.D. (cum laude) from Harvard Law School, an M.D. from Georgetown University School of Medicine, and a B.A. in Biology from Columbia University. He currently serves on the Board of Directors of Dicerna Pharmaceuticals, Inc. and Pernix Therapeutics Holdings, Inc. During the past five years, Dr. Langer served on the Boards of Delcath Systems, Inc. and Myrexis, Inc.

The Board of Directors has determined that Dr. Langer should serve on the Board for the following reasons: His medical background provides the Board with expertise on developing predictive, personalized, and prognostic testing products. Dr. Langer provides the Board with business and management expertise from senior positions at several major pharmaceutical companies,health care industry including expertise in commercializing health care products or services with emphasis in oncology, women’s health, and mental health. Healthcare market experience in both the United States and internationally is valued including experience with the U.S. and international healthcare regulatory environment.

13

S. Louise Phanstiel, a director of Myriad since September 2009, held several important positions at WellPoint, Inc. from 1996 to 2007,anticipating technological trends including as President, Specialty Products (2003 to 2007), Senior Vice President, Chief of Staffcommercial and Corporate Planningproduct digital solutions, disruptive innovation that extend or create new business models. Expertise in the Office of the Chairman (2000 to 2003),cyber security and Senior Vice President, Chief Accounting Officer, Controller, and Chief Financial Officer for all WellPoint, Inc. subsidiaries, including Blue Cross of California (1996 to 2000). Previously, Ms. Phanstiel was a partner at the international services firm of Coopers & Lybrand where she served clients in life and property/casualty insurance, high technology, and higher education. She currently serves on the Board of Directors of Verastem, Inc. and the Stony Brook Foundation. Ms. Phanstiel received a B.A. degree in Accounting from Golden Gate University and is a Certified risk management.

The Board of Directors has determined that Ms. Phanstiel should serve on the Board for the following reasons: She provides the Board with important expertise on the medical insurance industry based on her extensive experience in several senior positions at WellPoint and Blue Cross of California. This expertise is critical as we rely on third-party reimbursement for our molecular diagnostic services. Ms. Phanstiel also provides the Board with financial accounting and reporting expertise from her work at Coopers & Lybrand andCompany Governance – Experience as a Certified Public Accountant. In addition, she providesboard member of other publicly traded companies.

|  |  |  |  |  |  |  |  | |||||||||||||||||||||

| Board Diversity | Finance and Accounting | Leadership | Healthcare Industry | Diagnostic Industry | Research and Development | Provider or Payor Perspective | Technology | Public Company Governance | |||||||||||||||||||||

| S. Louise Phanstiel | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||

| Chair of the Board | |||||||||||||||||||||||||||||

| Paul M. Bisaro | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||

| Director | |||||||||||||||||||||||||||||

Paul J. Diaz President and CEO | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||

| Heiner Dreismann Ph.D. | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||

| Director | |||||||||||||||||||||||||||||

Rashmi Kumar Director | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||

| Lee N. Newcomer M.D. | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||

| Director | |||||||||||||||||||||||||||||

Colleen F. Reitan Director | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||

| Dan Skovronsky, M.D. Ph.D. | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||

| Director | |||||||||||||||||||||||||||||

| Daniel K. Spiegelman | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||

| Director | |||||||||||||||||||||||||||||

self-disclosed by our directors.

| Board Diversity Matrix (as of April 17, 2024) | ||||||||||||||

| Total Number of Directors | 9 | |||||||||||||

| Female | Male | Non-Binary | Did not Disclose Gender | |||||||||||

| Directors | 3 | 6 | — | — | ||||||||||

| Number of Directors who Identify in Any of the Categories Below: | ||||||||||||||

| African American or Black | — | — | — | — | ||||||||||

| Alaskan Native or Native American | — | — | — | — | ||||||||||

| Asian (other than South Asian) | 1 | — | — | — | ||||||||||

| South Asian | — | — | — | — | ||||||||||

| Hispanic or Latinx | — | 1 | — | — | ||||||||||

| Native Hawaiian or Pacific Islander | — | — | — | — | ||||||||||

| White | 2 | 5 | — | — | ||||||||||

| Two or More Races or Ethnicities | — | — | — | — | ||||||||||

| LGBTQ+ | — | — | — | — | ||||||||||

| Did not Disclose Demographic Background | — | — | — | — | ||||||||||

Mr. Spiegelman.

14

meeting.

investor.myriad.com/corporate-governance.

The Compensation CommitteeCHCC is charged with establishing a compensation policy for our executivesexecutive officers and directors that is designed to attract and retain qualified executive talent, to motivate them to achieve corporate

15

objectives, and reward them for superior performance. Our Compensation CommitteeCHCC is also responsible for establishing and administering our executive compensation policies and equity compensation plans. The Compensation CommitteeCHCC meets at least two times per year and more often as necessary to review and make decisions with regard to executive compensation matters. As part of its review of these matters, the Compensation CommitteeCHCC may delegate any of the powers given to it to a subcommittee. A copy of the Compensation Committee’sCHCC’s written charter is publicly available on the Investor Information — UnderstandingInvestors Relations—About Myriad/Corporate Governance section of our website atwww.myriad.com.

investor.myriad.com/corporate-governance.

CHCC.

directors.

16

stockholder recommendations for proposed director nominees must be made in writing to the Nominating and Governance Committee,NESGC, care of Myriad’s Corporate Secretary at 320 Wakara Way,322 North 2200 West, Salt Lake City, Utah 84108,84116, and must be received no later than 120 days prior to the first anniversary of the date of the proxy statement for the previous year’s Annual Meeting. The recommendation must be accompanied by the following information concerning the recommending stockholder:

17

Nasdaq.

investor.myriad.com/corporate-governance.

investor.myriad.com/corporate-governance.StrategicResearch and Product Innovation Committee.Our StrategicResearch and ProductInnovation Committee (or "RPIC") met twothree times duringin the 2023 fiscal 2017. This committeeyear. The RPIC currently has threefour members: Dr. Henderson (chair)Newcomer (Chair), Mr. BestBisaro, Dr. Dreismann, and Dr. Dreismann.Skovronsky. The committee’s roles and responsibilities are set forth in the Strategic Committee’sRPIC’s written charter and include advising and consulting with senior management on a broad range of strategic and product development initiatives and making recommendations to the Board regarding such opportunities. A copy of the Strategic Committee’sRPIC’s written charter is publicly available on the Investor Information — UnderstandingInvestors Relations—About Myriad/Corporate Governance section of our website atwww.myriad.com.1823

Compensation Committee Interlocks and Insider Participation. Our Compensation Committee currently has three members: Dr. Dreismann (Chair), Dr. Gilbert, and Dr. Henderson. No member of our Compensation Committee has at any time been an employee of the Company. None of our executive officers is a member of the Compensation Committee, nor do any of our executive officers serve as a member of the Board of Directors or Compensation Committee of any entity that has one or more executive officers serving as a member of our Board of directors or Compensation Committee.

| Name | Age | Position | ||||||||||

| 62 |

| ||||||||||

| President and Chief Executive Officer and Director | |||||||||||

| 54 | Senior Vice President, | ||||||||||

| 39 | |||||||||||

Scott J. Leffler (1) | 49 | Chief Financial Officer | ||||||||||

| Dale Muzzey | Chief Scientific Officer | |||||||||||

Sam S. Raha (2) | 52 | Chief Operating Officer | ||||||||||

| Shereen Solaiman | Chief People Officer | |||||||||||

| Mark Verratti | 55 | Chief Commercial Officer | ||||||||||

| Paul J. Diaz | ||||||||||||||

| President and Chief Executive Officer | |||||||||||||

Paul J. Diaz. Please see biography above under ‘‘Management and Corporate Governance—Board Composition and Refreshment.’’ | ||||||||||||||

Age:62 | ||||||||||||||

| Margaret Ancona | |||||||||||||||||

| Senior Vice President, | ||||||||||||||||

| Maggie Ancona joined Myriad | ||||||||||||||||

Age: 54 | |||||||||||||||||

| Kevin R. | ||||||||||||||

| Chief Technology Officer | |||||||||||||

Kevin R. Haas joined Myriad in May 2013 and was appointed Chief Technology Officer in February 2021. Previously, he was Senior Vice President of Technology and Senior Vice President of Engineering at Myriad and Vice President of Bioinformatics and Senior Director of Bioinformatics at Myriad Women's Health. Dr. Haas previously served on the Board of Directors and as Vice President for USA Triathlon, the non-profit national governing body for the sport. Dr. Haas received a B.S. from University of Wisconsin-Madison and a Ph.D. in Chemical Engineering from University of California-Berkeley, where he worked on molecular simulation and machine learning to study protein dynamics from single molecule fluoresce. He has co-authored 16 peer reviewed publications and nine patent applications. | ||||||||||||||

Age: 39 | ||||||||||||||

| Scott J. Leffler | ||||||||||||||

| Chief Financial Officer | |||||||||||||

Scott J. Leffler became Chief Financial Officer of Myriad on January 29, 2024. Prior to joining Myriad, he served as Chief Financial Officer of Clover Health Investments, Corp. since July 2022. Before joining Clover Health, Mr. Leffler served as Chief Financial Officer and Treasurer of Sotera Health, a provider of sterilization, lab testing and advisory services for the healthcare industry, from April 2017 to July 2022. Prior to joining Sotera Health, Mr. Leffler served as Chief Financial Officer at Exal Corporation (now called Trivium Packaging) and held various financial leadership positions at PolyOne Corporation (now called Avient). Mr. Leffler holds a B.A. in economics from Yale University and an M.B.A. from Emory University and is both a Certified Public Accountant (inactive) and a Certified Treasury Professional (inactive). | ||||||||||||||

| Dale Muzzey | ||||||||||||||

| Chief Scientific Officer | |||||||||||||

Dale Muzzey was appointed Chief Scientific Officer of Myriad in April 2022. Previously, he served at Myriad as Interim Chief Scientific Officer and Senior Vice President, R&D from January 2022 to April 2022, Vice President, Bioinformatics, from October 2019 to December 2021, and Senior Director, Clinical Development from August 2018 to September 2019. From April 2014 to July 2018, Dr. Muzzey also served in a number of positions of increasing responsibility at Myriad Women's Health, including Director, Scientific Affairs, Staff Scientist, Computational Biology, Senior Scientist, and Computational Scientist I. Dr. Muzzey received a Bachelor of Arts degree in Biochemical Sciences and a Ph.D. in Biophysics from Harvard University. | ||||||||||||||

Age: 44 | ||||||||||||||

| Sam S. Raha | ||||||||||||||

| Chief Operating Officer | |||||||||||||

Sam S. Raha became Chief Operating Officer of Myriad in December 2023. Prior to joining Myriad, he served as Senior Vice President and President, Diagnostics and Genomics Group, of Agilent Technologies, Inc. since April 2018. From May 2017 to April 2018, Mr. Raha served as Agilent's Senior Vice President, Strategy and Corporate Development. From July 2013 to January 2017, he served as Vice President, Global Marketing for Illumina, Inc., and from 2008 to 2012, he served as Vice President and General Manager, Genomics Assays / NextGen qPCR for Life Technologies, Inc. Mr. Raha graduated from the University of California, Berkeley, with a degree in molecular and cell biology and received his MBA from Santa Clara University. | ||||||||||||||

Age: 52 | ||||||||||||||

| Shereen Solaiman | ||||||||||||||

| Chief People Officer | |||||||||||||

Shereen Solaiman, Chief People Officer, joined Myriad Genetics in March 2023. She previously served for over 12 years with OhioHealth, a not-for-profit, faith-based health system, most recently as Senior Vice President, Chief Human Resource Officer from August 2020 to October 2022. Prior to that role, she served in a number of positions at OhioHealth of increasing responsibility, including Vice President, HR Strategy and Business Enablement, from January 2018 to August 2020, Vice President, Total Rewards, from July 2016 to January 2018, and Vice President, Human Resources Central Ohio and Corporate, from October 2014 to July 2016. Prior to OhioHealth, she served over ten years at Borders Group, Inc., in a variety of human resources roles, including as Senior Vice President, Human Resources. She received a B.S. in Journalism and Public Relations from Ohio University and a Masters in Public Administration from New York University. | ||||||||||||||

Age: 51 | ||||||||||||||

| Mark S. Verratti | |||||||||||||||||

| Chief Commercial Officer | ||||||||||||||||

Mark Verratti | was promoted to Chief Commercial Officer on April 14, 2022. He previously served as President, Mental Health or President, Myriad Neuroscience from August 2017 to April 2022, and as President of Myriad Autoimmune from May 2020 until the sale of the Myriad Autoimmune business in September 2021. Prior to his appointment as President, Myriad Neuroscience, he served as SVP, Chief Sales and Business Development officer at Assurex Mr. Verratti also held senior leadership positions worldwide with Cyberonics (now known as LivaNova) from 2005-2016, and earlier with Forest Pharmaceuticals where he led commercial teams with revenues approaching $500 million dollars. He received a B.S. in Life Sciences with a minor in Physiology from The Pennsylvania State University. | ||||||||||||||||

Age: 55 | |||||||||||||||||

19

Mark C. Capone. Please see biography above under “Management and Corporate Governance — The Board of Directors.”

Alexander Ford, President of Myriad Genetic Laboratories, Inc. (“MGL”), a wholly owned subsidiary of Myriad, has served in his current role since July 1, 2015. Mr. Ford joined Myriad in June 2010. Before being named to his current position, he served as the Chief Commercial Officer of MGL. Prior to joining Myriad, Mr. Ford held leadership positions at Novartis, Sanofi-Aventis, Nektar Therapeutics and Pfizer in the areas of Marketing Research, Product Marketing, Managed Care, Sales and Business Development. He has more than 25 years of experience in the pharmaceutical and biotechnology industries. Mr. Ford received his B.A. degree in Communications from the University of North Carolina, Wilmington and his M.A. degree from New York University.

Gary A. King, Executive Vice President, International Operations, joined us in July 2010. Mr. King has been employed in the life sciences industry for more than 25 years. From June 2008 to June 2010, he was the Chief Executive Officer of AverDx Incorporated, an international biotechnology company that develops novel biomarker diagnostics for critical diseases. From June 2002 to February 2008, he served as Vice President, International Operations at Biosite Incorporated, a developer of diagnostic products and antibody development technologies where he spent six years building and leading all of the company’s commercial activities outside the United States. Mr. King received his B.A. degree in Zoology from Pomona College and a M.B.A. degree from Stanford University.

Jerry S. Lanchbury, Ph.D., Chief Scientific Officer, joined the Company in September 2002 as Senior Vice President of Research. In July 2005 he was appointed Executive Vice President of Research, a position he held until he was named to his current position in February 2010. Dr. Lanchbury came to us from GKT School of Medicine, King’s College where he had served as Reader in Molecular Immunogenetics and Head of Molecular Immunogenetics Unit since 1997. Dr. Lanchbury earned his Ph.D. from the University of Newcastle upon Tyne and 1st Class Honours, B.Sc. “Biology of Man & his Environment” degree from the University of Aston.

Richard M. Marsh, Esq.,Executive Vice President, General Counsel and Secretary, joined Myriad in November 2002. He previously served as Director of Intellectual Property (2001-2002), Acting General Counsel and Secretary (2000-2001), and Director of Commercial Legal Affairs (1998-2000) for Iomega Corporation. Mr. Marsh served as a partner with the law firm of Parsons, Behle & Latimer in Salt Lake City from 1989 to 1998. He received an LL.M. degree in Taxation from Georgetown University Law Center, a J.D. degree, magna cum laude, from Thomas M. Cooley Law School, and a B.S. degree in accounting from Brigham Young University, and was formerly a Certified Public Accountant.

Ralph L. McDade, Ph.D., President of Myriad RBM, Inc., a wholly owned subsidiary of Myriad, has served in his current role since January 2014. Previously, he served as Chief Operating Officer of Myriad RBM. Dr. McDade was formerly Strategic Development Officer for Myriad RBM and was in that position since the company’s inception in 2002. Prior to joining Myriad RBM, he was Chief Scientific Officer for Luminex Corporation from 1996 to 2002, where he was closely involved with the development of xMAP technology. Dr. McDade received his Ph.D. in Microbiology from the University of Texas Southwestern Medical School in 1980. Following postdoctoral training at The University of Connecticut Medical Center in Farmington, he held faculty positions at the Rockefeller University in New York and at Louisiana State University School of Medicine in New Orleans.

R. Bryan Riggsbee, Chief Financial Officer and Treasurer, joined us in October 2014. He previously served 10 years with Laboratory Corporation of America (LabCorp) where his most recent position was as Senior Vice President of Corporate Finance with responsibility for the financial planning and analysis and treasury functions. Prior to LabCorp, Mr. Riggsbee served in various finance roles with General Electric and began his career in the audit division of KPMG. He received a B.A. in Accounting from North Carolina State University, a B.A. in political science from the University of North Carolina at Chapel Hill and an M.B.A. from Northwestern University. Mr. Riggsbee is a Certified Public Accountant licensed in the State of North Carolina.

20

Bernard F. Tobin, President of Crescendo Bioscience, Inc., has served in that role since January 2015. He previously held several senior positions at Amgen over the course of 8 years, including Executive Director of National Accounts, General Manager of both the Netherlands and Brazil, and Global Head of Commercial Excellence. In addition, he led the global integration of business development acquisition in more than 100 countries. Prior to that, Mr. Tobin held a variety of leadership roles in the commercial organization at Eli Lilly and Co. over the course of 16 years. He received his B.S. degree in public service and administration from Iowa State University and his M.B.A from the Fuqua School of Business, Duke University.

Mark Verratti,President Assurex Health, Inc., a wholly owned subsidiary of Myriad, has served in his current role since August 1, 2017. He previously served as SVP, Chief Sales and Business Development officer at Assurex since January 2016. Mr. Verratti also held senior leadership positions with Cyberonics (now known as LivaNova) from 2005-2016, and earlier with Forest Pharmaceuticals where he led commercial teams with revenues approaching $500 million dollars. He received a B.S. in Life Sciences with a minor in Physiology from The Pennsylvania State University.

21

EXECUTIVE COMPENSATION

The four

| Name | Title | ||||

| Paul J. Diaz | President and Chief Executive Officer | ||||

| R. Bryan Riggsbee | Former Chief Financial Officer (1) | ||||

| Samraat S. Raha | Chief Operating Officer (2) | ||||

| Nicole Lambert | Former Chief Operating Officer (3) | ||||

| Mark S. Verratti | Chief Commercial Officer | ||||

| Dale Muzzey, Ph.D. | Chief Scientific Officer | ||||

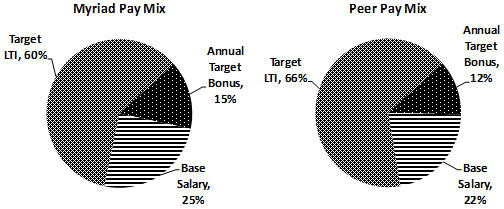

Peer Pay Mix data is a composite of our peer group data and published survey data.

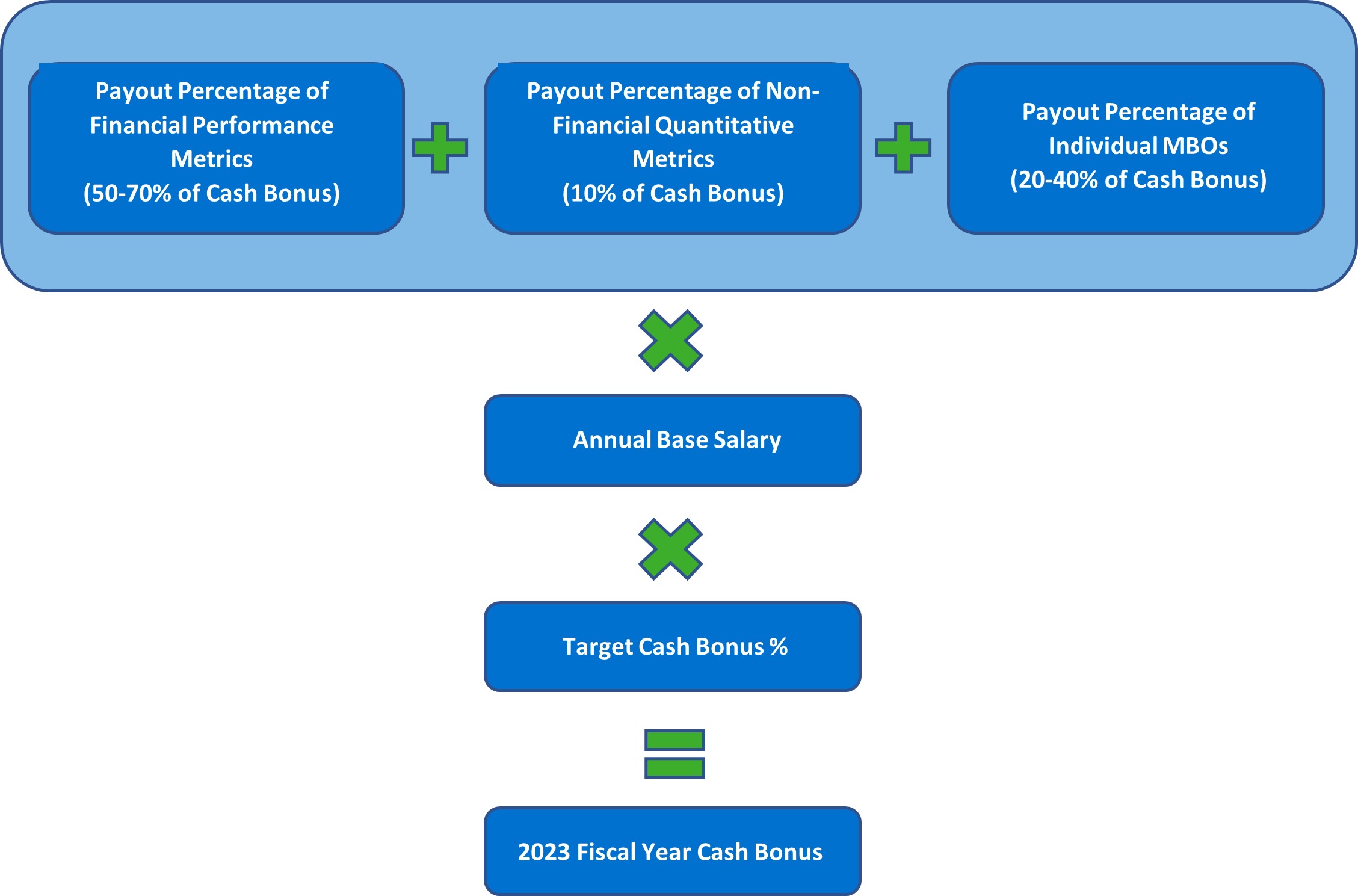

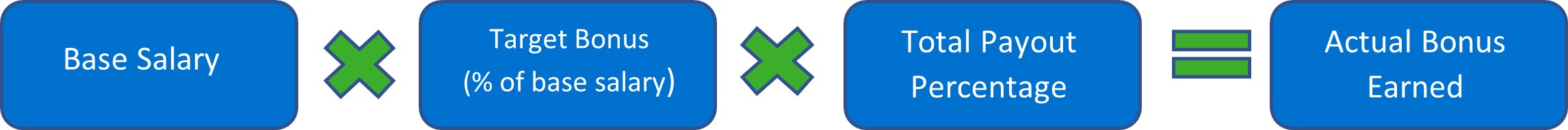

Our compensation program seeks to align compensation with Company performance and hence reward our executive officers for their contribution to our growth, profitability, and increased stockholder value, and employee engagement through the recognition of individual leadership, initiatives, achievements, and other contributions. EachFor short-term incentive awards for our executive officers for the 2023 fiscal year, our Compensation and Human Capital Committee approves Management Business Objectives("CHCC") approved Company performance metrics and employee and customer engagement metrics as well as individual management business objectives (“MBOs”) for, which consist of goals tailored to each executive officer that consistofficer. The short-term incentive award component of (i) pre-establishedour executive officers' compensation was balanced among the following factors:

22

Fiscal Year 2017 Performance

Forcustomer NPS each represented 5% of an executive officer's total score, and individual MBOs accounted for the remaining 20-40%, as noted in the following illustration:

| 50% of Equity Grant | 50% of Equity Grant | |||||||

| RSUs | PSUs | |||||||

•Number of RSUs granted is fixed at the grant date by the CHCC •Time-based vesting over three years (33.33% each year) | •Target number of PSUs is set at the grant date by the CHCC •Actual number of units granted is subject to Company performance based on revenue, adjusted earnings per share and relative total stockholder return targets during a three-year measurement period •Vest on three-year anniversary of the grant date | |||||||

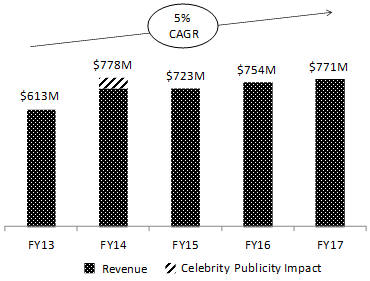

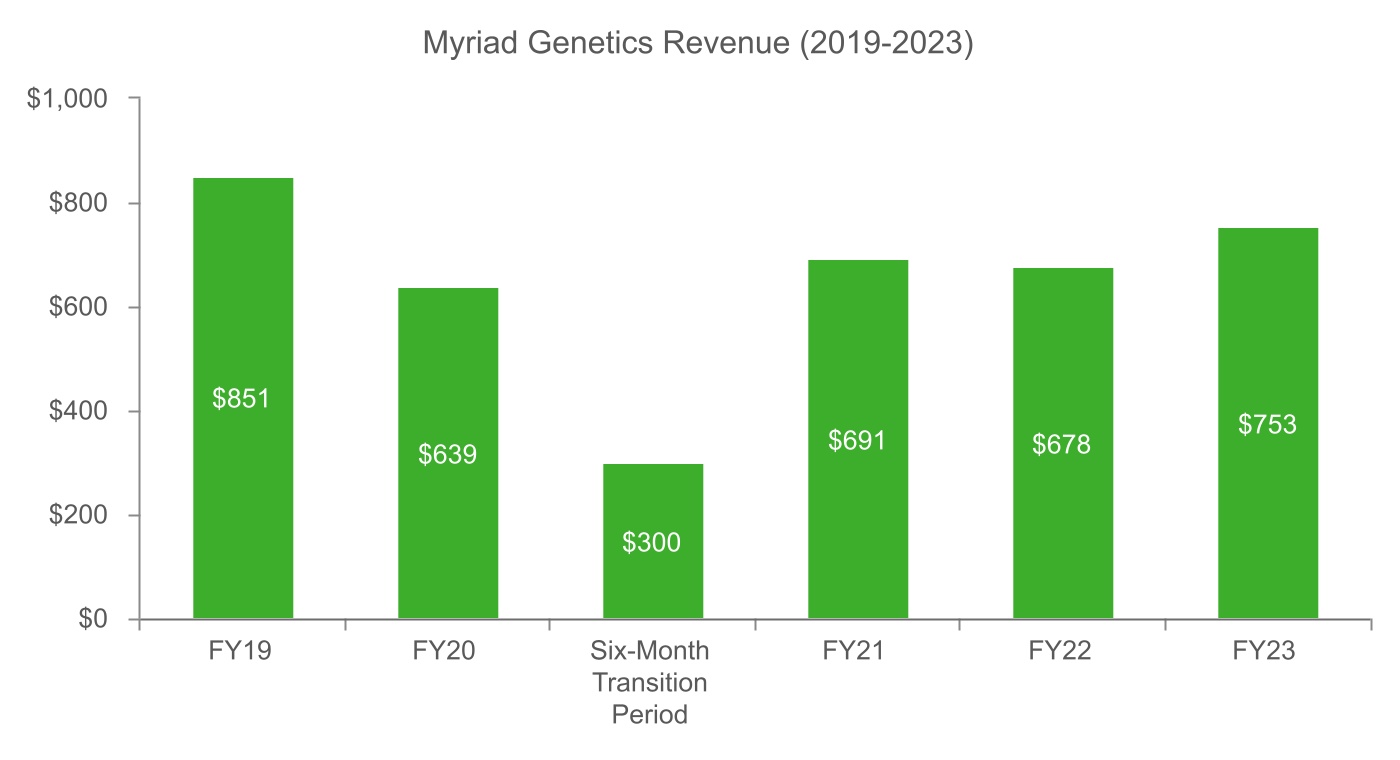

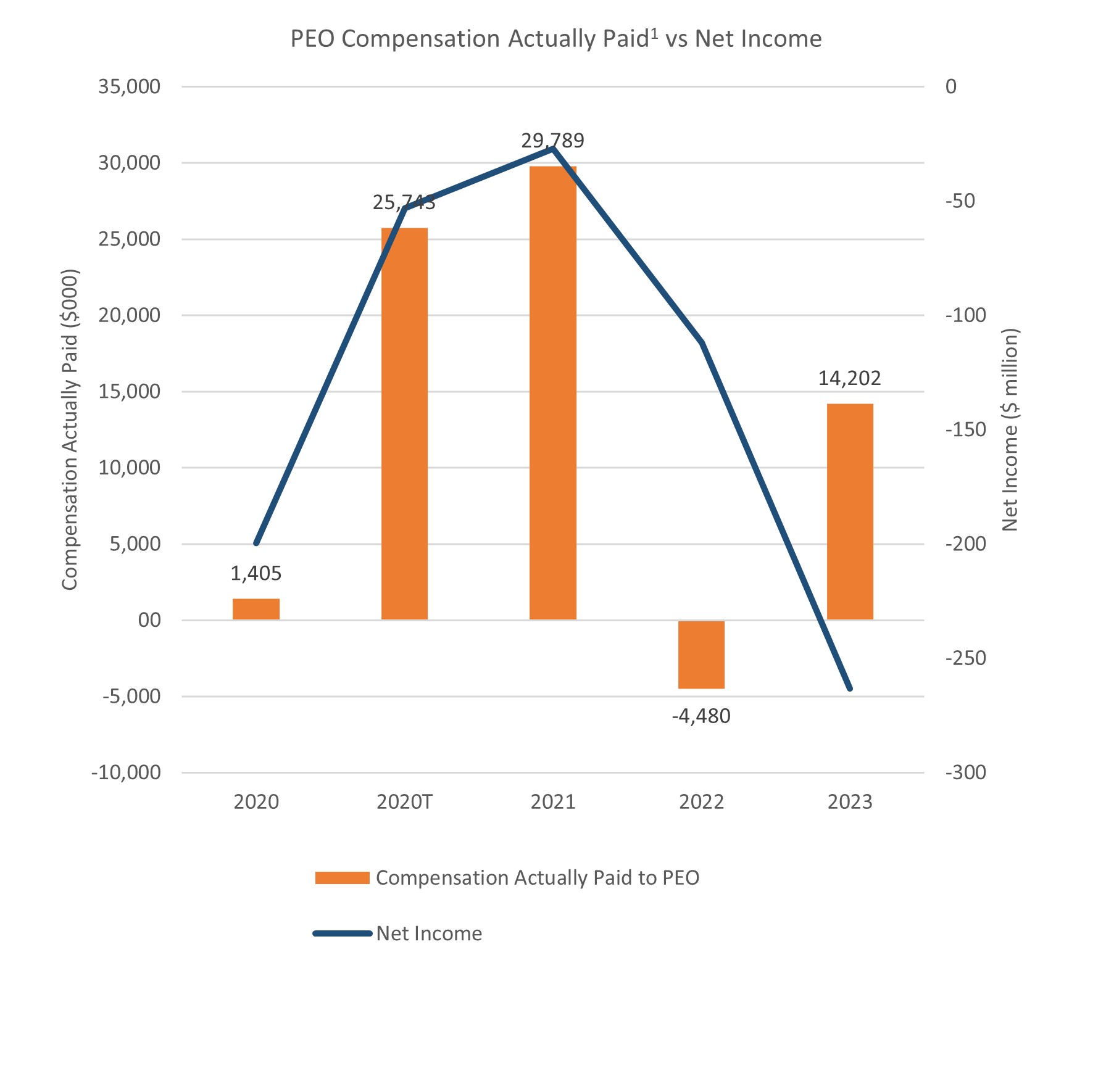

We continued generating strong cash flows from operations7%, respectively. GAAP operating loss was $(257.4) million, and adjusted operating loss was $(25.5) million, an improvement of $7.3 million compared to adjusted operating loss of $(32.8) million in fiscal year 2017 we generated2022. GAAP loss per share was ($3.18) and non-GAAP adjusted loss per share was ($0.27) for the year ended December 31, 2023. GAAP operating expenses were $774.4 million and non-GAAP adjusted operating expenses were $545.5 million, an increase of 6.8% year over $100 million in GAAP free cash flow. year.

activities.

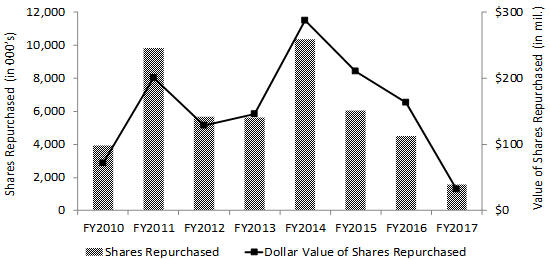

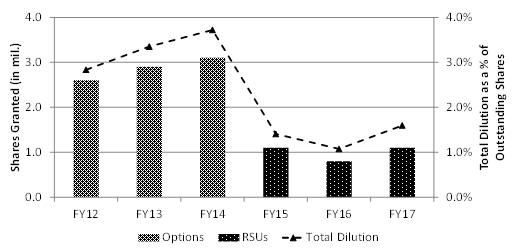

During fiscal year 2017 we reduced the level of our share repurchases to 1.6 million shares as we focused on reducing the balance on our credit facility associated with the Assurex acquisition. Since fiscal year 2010, we have purchased over 49 million shares of our common stock under our stock repurchase program for $1.239 billion at a weighted average price of $25.18 per share.

23

the 2023 fiscal year increased 11% from the 2022 fiscal year, driven by growth in Prenatal, Prolaris, GeneSight and Hereditary Cancer.

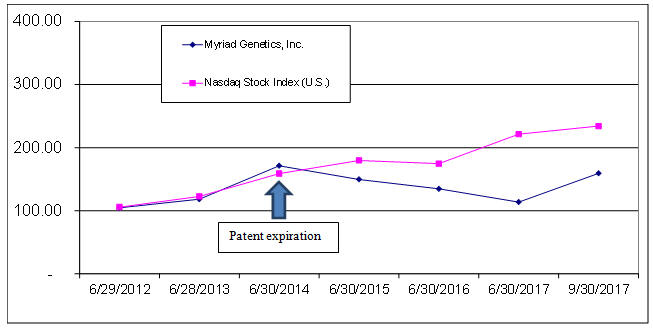

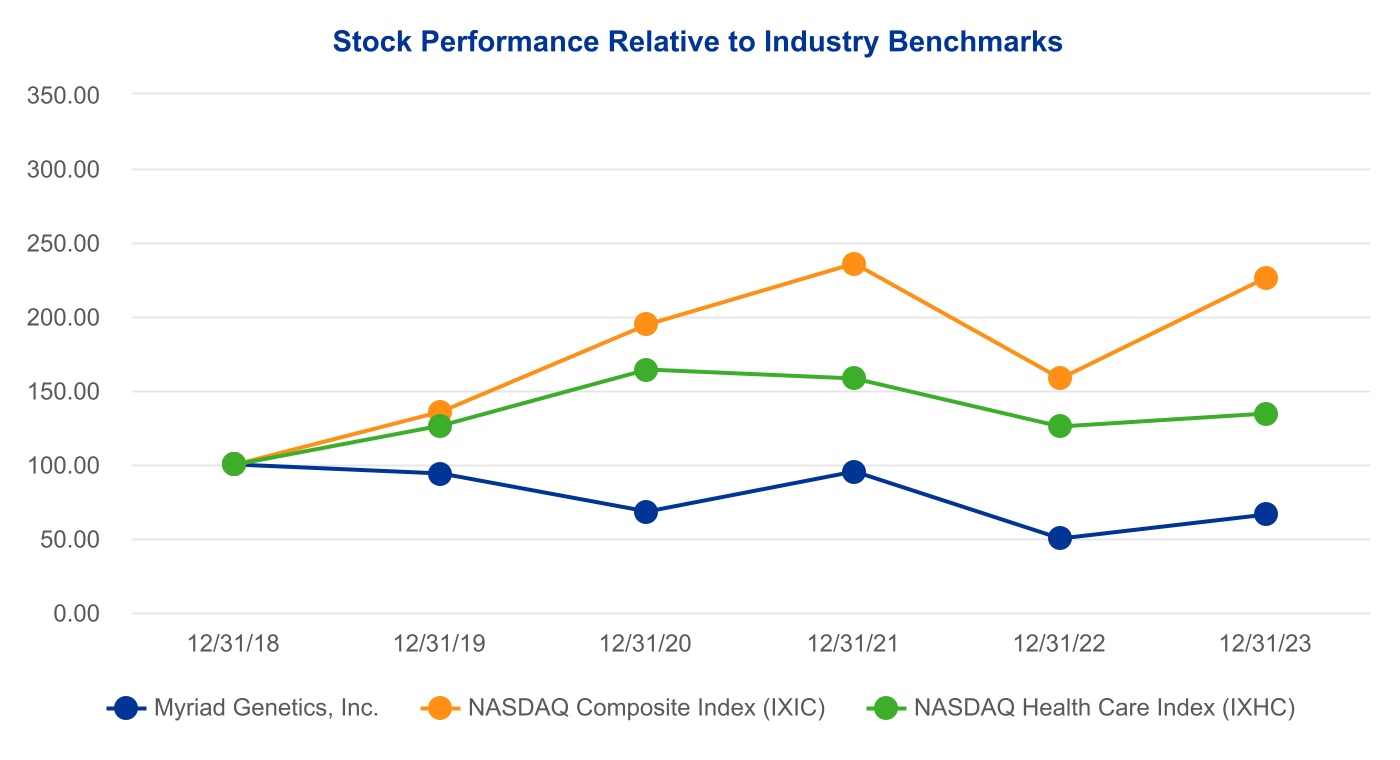

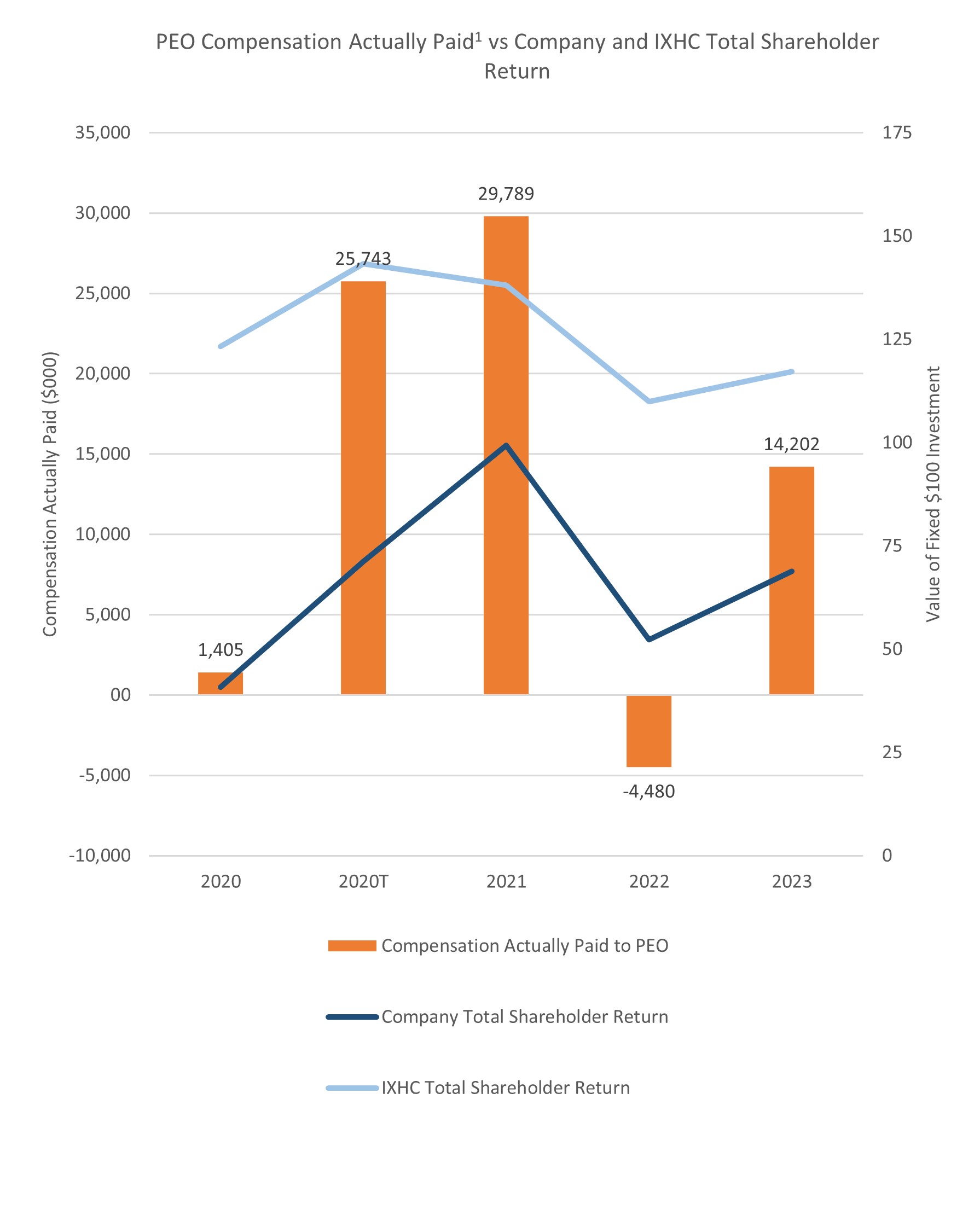

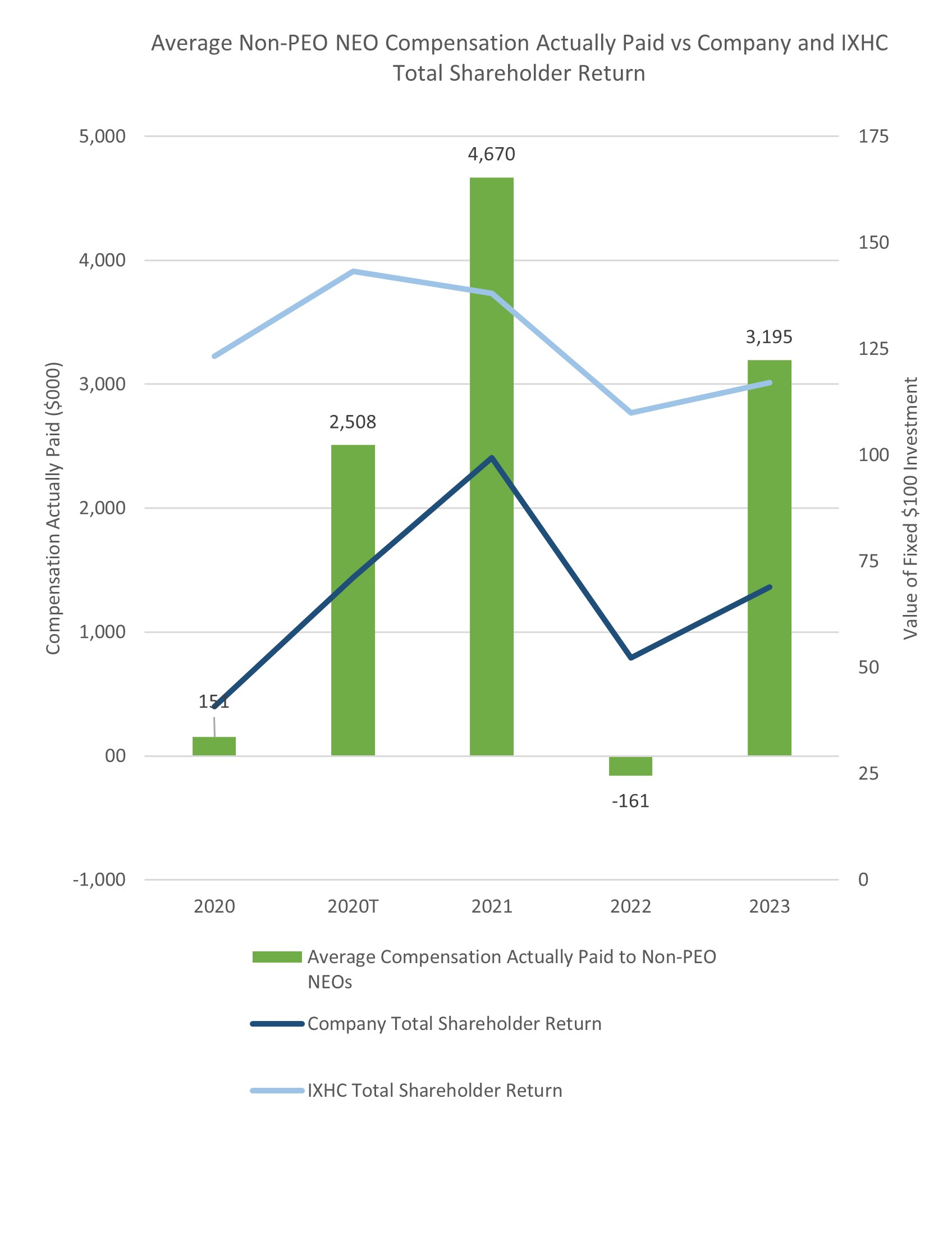

IXHC in our stock performance chart because the IXHC is comprised of companies which also operate in the healthcare industry. We caution that historical stock price performance, including the stock price performance shown in the chart below, is not necessarily indicative of, nor is it intended to forecast, the potential future performance of our common stock.

Stabilizebusiness units:

24

Grow new product volume

Expand reimbursement coverage for new products

25

Increase RNA kit revenue internationally

Improve profitability with Elevate 2020

Performance Payfour NEOs for Fiscal Year 2017

To reflect our pay for performance philosophy, based on the Company’s performance for fiscal year 2017, our Compensation Committee:

Additionally, the Compensation Committee determined to freeze the level of RSUs awarded to our executive officers at the levels awarded in fiscal year 2016 aligning total compensation to our goal of between the 50th to 75th percentile of our compensation benchmarks.

Say-on-Pay Results

Additionally, we considered concerns raised by ISS

26

Changes To Our Pay Practices and Philosophy

In response to the feedback expressed by our stockholders, ISS and Glass Lewis, we are making the following changes, or continuing prior responsive practices, to our executive compensation program:

27

Pay Practices

Previously, we adopted other practices thatbelieve reflect the high standards our Compensation CommitteeCHCC seeks to attain forto support our compensation philosophy and pay practices, such as:

| What We Do: | What We Don't Do: | ||||

•Grant 50% of executive officers' equity in the form of PSUs that are subject to objective performance metrics | •Reprice stock options | ||||

•Cap PSUs earned at target if absolute total stockholder return is negative over the performance period | •Provide single-trigger change of control vesting for equity awards for executive officers | ||||

•Establish challenging performance metrics, including revenue and adjusted operating income targets | •Guarantee bonuses | ||||

•Require directors and executive officers to meet robust stock ownership guidelines | •Grant in-the-money stock options | ||||

•Provide full vesting of RSUs under our 2023 long-term incentive plan to executive officers only after three years | •Provide excessive perquisites | ||||

•Evaluate officer compensation levels against a peer group of similarly situated companies | •Repurchase underwater stock options | ||||

•Retain an independent compensation consultant | |||||

•Prohibit hedging transactions (no waivers granted) | |||||

•Utilize employee engagement and customer net promoter score as performance metrics in our 2023 short-term incentive plan | |||||

•Prohibit short sales, put and call options and other speculative transactions | |||||

•Prohibit pledging or the use of common stock to secure a margin or other loan (no waivers granted) | |||||

•Hold an annual advisory vote on executive compensation | |||||

•Subject incentive compensation to recoupment under our clawback policy | |||||

In connection with the annual review of our executive compensation program and compensation pay components, we will continue our general approach of establishing Company Financial MBOs and Individual MBOs for our executive officers. These MBOs assist the Compensation Committee in evaluating the performance of our executive officers and to then reward them through short- and long-term incentive compensation for the value they deliver to our stockholders as demonstrated by the enhanced growth and profitability of the Company.

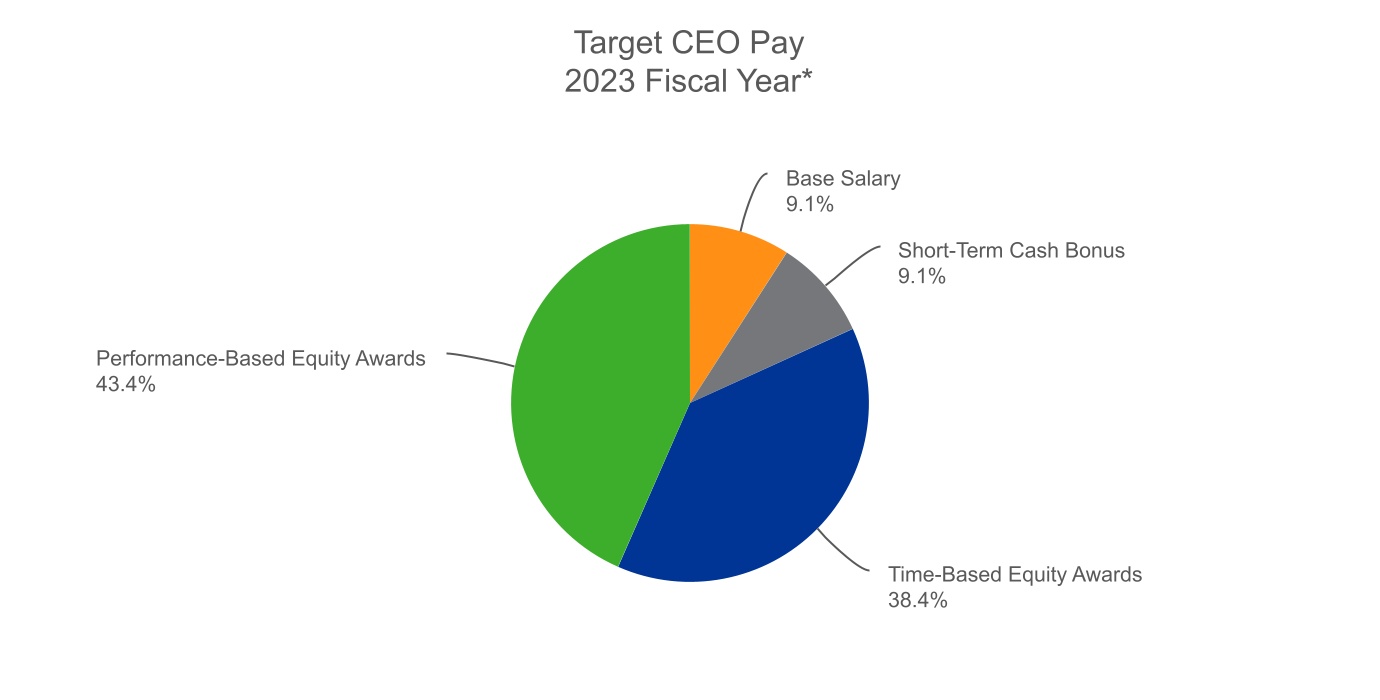

program. for fiscal year 2023.2023 Fiscal Year 2017 Named Executive Officer CompensationElements of our Compensation ProgramThe compensation program for our executive officers consists principally of a base salary, an annual cash incentive bonus, long-term compensation inWhile the form of a three-year cash incentive bonus award and equity incentive compensation in the form of restricted stock units with a performance-based factor applicable to our NEOs. We believe that these elementscomponents of our compensation strike an appropriate balance to incentivize and reward our executive officers for ongoing, short- and long-term performance.program are discussed in detail in the following pages, below is a brief introduction:•Base Salary: An annual base salary provides the foundation of our compensation program and ensures that the executive officer is being paid ongoing compensation, which allows us to attract and retain high-quality talent.•Short-Term Incentive Award: The annual cashshort-term incentive bonusaward forms an important part of our compensation strategy by providing an incentive to rewardachieve short-term performance goals as measured by Company performance, an employee engagement score, customer NPS, and accomplishment of individual MBOs. The long-term cash incentive bonus awards and equity•Equity: Equity incentive compensation also formforms an important part of our compensation strategy. These incentive bonus awards and equityEquity grants reward our executive officers for the long-term performance of Myriad,the Company and help to ensure that our executive officers have a stake in our long-term success by providing an incentive to improve our overall growth and stockholder value. For example, under our long-term cash incentive awards,financial and stock price performance metrics are measured by achieving three-year financial performance targets reflecting growth of revenue, diversifying revenues and improving operating margins. These performance metricsincluded that align with our strategic goals and objectives and thus alignsalign the executive officers’ interests with stockholders’ long-term interests.28The Compensation Committee,CHCC, in collaboration with management, attempts to develop an overall compensation program that incentivizes the executive officers to achieve their objectives without encouraging them to take excessive risks to the business. We believe that this objective is accomplished through the balance ofby appropriately balancing the various elements of our compensation program, including the establishment of annual MBOs for each of the executive officers to appropriately guide their performance objectives, establishment of preset annual and three-year growth financial performance targets, and preset limits on cash incentive compensation.Formulating and Setting Executive CompensationThe Compensation CommitteeCHCC is responsible for formulating, evaluating and approving the compensation, including the award of equity compensation, for our executive officers, including our President and CEO.officers. The Compensation CommitteeCHCC also assists the full boardour Board in establishing appropriate incentive compensation and equity-based plans generally for all employees and is responsible for administering these plans.ForDuring fiscal year 2017,2022, the Compensation CommitteeCHCC retained an independent compensation consultant, Mercer, (US) Inc. (“Mercer”) for the purpose of updatingto review our peer group of companies and to provide competitive market data on the salary, short-term incentive compensation, and long-term incentive compensation of executive officers at comparable companies within our industry.industry (the "2022 Mercer Executive Compensation Review"). The Compensation Committee usesCHCC used this competitive market data on compensation in determining annual salary compensation,base salaries, short-term (annual) incentive compensation, and long-term equity incentive compensation (both cash and equity incentive compensation) for the President and CEO and otherour executive officers of the Company (the “2017 Mercer Executive Compensation Review”).35

| Alkermes plc | ||||||||

| BioMarin Pharmaceutical Inc. | Ironwood Pharmaceuticals, Inc. | |||||||

| Bio-Techne Corporation | Jazz Pharmaceuticals plc | |||||||

| bluebird bio, Inc. | Natera, Inc. | |||||||

| Coherus BioSciences, Inc. | Neogenomics, Inc. | |||||||

| Exact Sciences Corporation | Neurocrine Biosciences Inc. | |||||||

| Exelixis Inc. | Seagen Inc. | |||||||

| lncyte Corporation | United Therapeutics Corporation | |||||||

| Vanda Pharmaceuticals Inc. | ||||||||

| Invitae Corporation | ||||||||

We believe that the compensation information obtained from the 2017 Mercer Executive Compensation Review provides us appropriate compensation data and benchmarks, because it is derived from companies that are in our industry, share similar corporate structures, and have similar factors such as number of employees, market value, revenues, net income, product pipeline and gross margins. Through Mercer, we have selected those companies that we believe represent the various factors of our business as outlined above.

Utilizing Using the composite peer group data provided to us in the 20172022 Mercer Executive Compensation Review, the Compensation CommitteeCHCC analyzed among other criteria, the average salary, short-term incentive bonus compensation, and long-term incentive bonus compensation (both cash and equity compensation) for each of our executive officers at the 25th, 50th and 75th percentile ranges. In addition, for long-term incentive equity compensation, the Compensation Committee analyzed, among other criteria, the average equity compensation for each of our executive officers at the 25th, 50th25th, 50th and 75th75th percentile range fromranges.

29